accumulated earnings tax irs

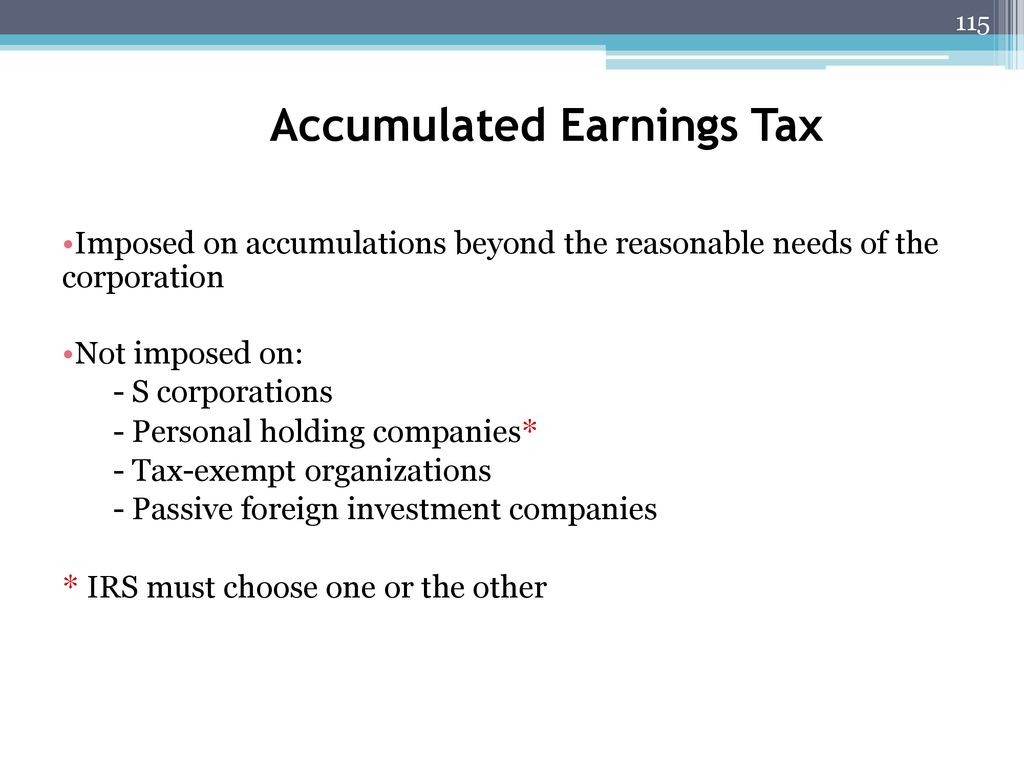

Accumulated tax earning is a form of encouragement by the government to give out dividends rather than keeping their earnings. The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings.

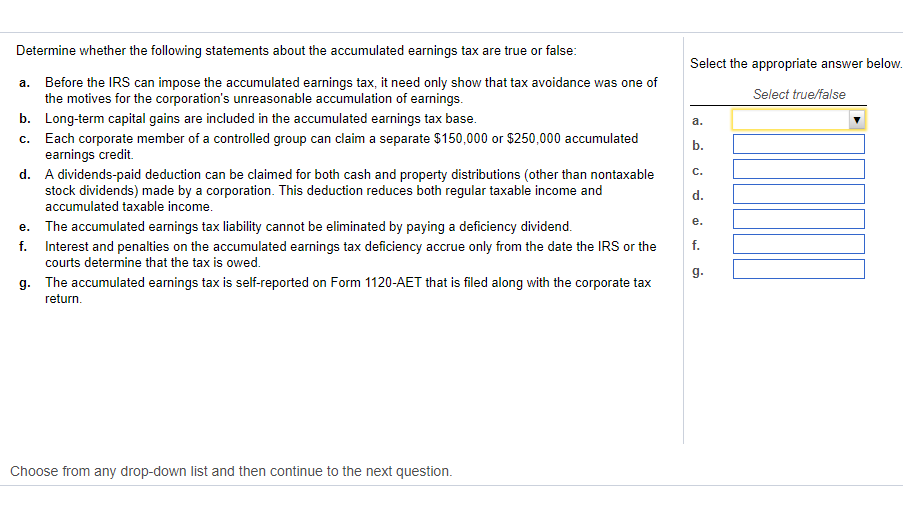

Solved Determine Whether The Following Statements About The Chegg Com

The accumulated earnings tax equals 396 percent of.

. Accumulated earnings penalty is accumulated taxable income. The accumulated earnings credit allowable under section 535 c 1 on the basis of the reasonable needs of the business is determined to be only 20000. Distributions of Stock or Stock Rights.

The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company. Accumulated Earnings Tax Distributions to Shareholders Money or Property Distributions Amount distributed. In addition to other taxes imposed by.

It is a form of tax imposed by the Federal Government on. It compensates for taxes which. Calculating the Accumulated Earnings Tax Since the accumulated earnings tax is 20 of the accumulated earnings tax base it is 1 st necessary to determine that amount.

The accumulated earnings tax is imposed on the accumulated taxable income of every corporation formed or availed of for the purpose of avoiding the income tax with respect to its. The accumulated earnings tax can be a hidden penalty tax on highly profitable corporations that allow their earnings to accumulate without paying adequate or any. The accumulated earnings tax is equal to 20 of the accumulated taxable income and is imposed in addition to other taxes required under the Internal Revenue.

The tax rate on accumulated earnings is 20 the maximum rate at which they would. The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the income. This tax can be assessed by the IRS on accumulated retained earnings that have not been earmarked for a clear purpose.

Internal Revenue Service IRS sets the accumulated earnings tax scheme to prevent companies from excessively accumulating their. If you received a distribution for this tax year from a trust that accumulated its income instead of distributing it each year and the trust paid taxes on that income you must complete Form. In addition to other taxes imposed by this chapter there is hereby imposed for each taxable year on the accumulated taxable income as defined in section 535 of each corporation described.

A personal service corporation PSC may accumulate earnings up to 150000 without having to pay this tax. This taxadded as a penalty to a companys income tax. To avoid having to pay for accumulated earnings tax Company A has to distribute at least 100000 of net income as dividends.

An accumulated earnings tax is a tax imposed by the federal government on companies with retained earnings deemed to be unreasonable and in excess of what is. 150000 200000 - 100000 250000. Accumulated earnings taxaet is imposed by internalrevenue code irc section 531on c corporations formed or availed offor the purpose of avoiding the imposi-tion of.

Accumulated Earnings Tax IRC 531 The purpose of the accumulated earnings tax is to prevent a corporation from accumulating its earnings and profits beyond the reasonable. The purpose of accumulated earning tax is to discourage the accumulation of profits if the purpose of such accumulation is to enable shareholders to avoid paying taxes on those profits. The main focus in an IRS proposal of tax here is usually the accumulated earnings credit which.

A corporation determines this amount by adjusting its taxable income for economic items to better reflect how much cash it. Accumulated Earnings and Profits CreditBalance Key Balance forward 1231Year Taxable income from Form 1120 line 28 or comparable line of other income tax return. Tax Rate and Interest If a corporation accumulates earnings that.

Gain from property distributions. And there is permitted usually a 250000 minimum accumulation of earnings. The federal government discourages companies from stockpiling their capital by using the accumulated earnings tax.

How To Calculate The Accumulated Earnings Tax For Corporations Universal Cpa Review

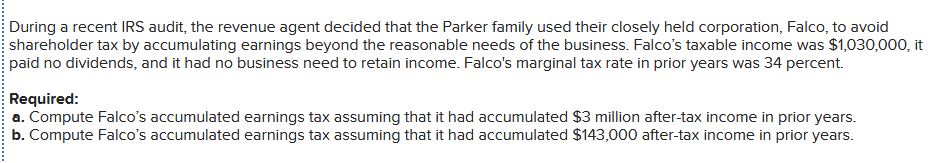

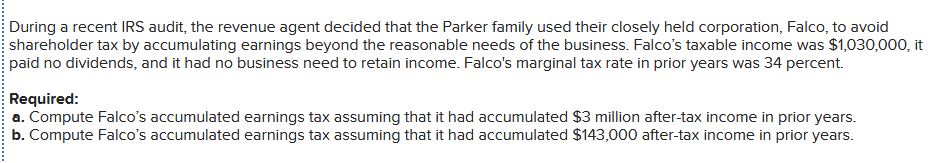

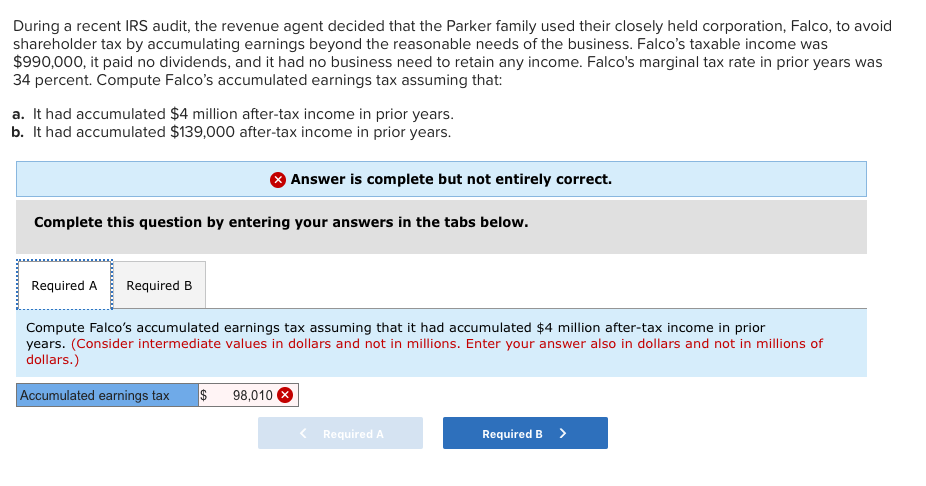

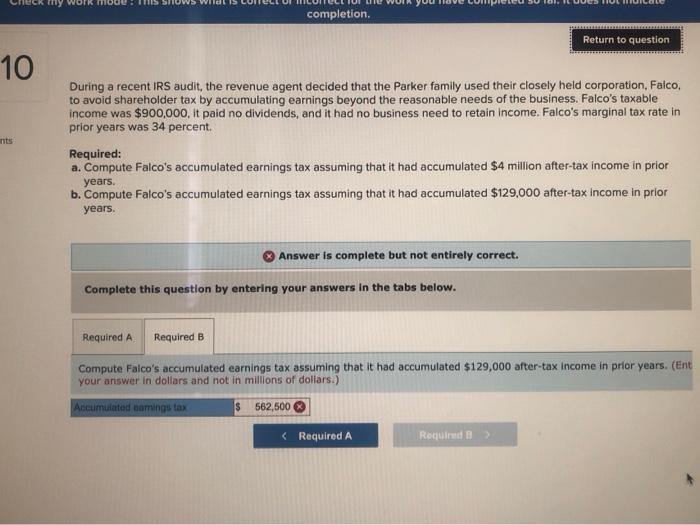

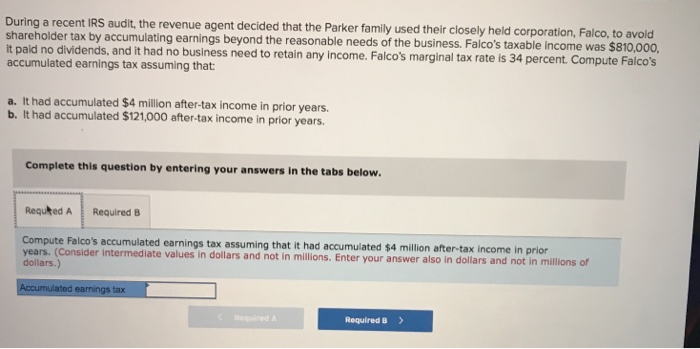

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Demystifying Irc Section 965 Math The Cpa Journal

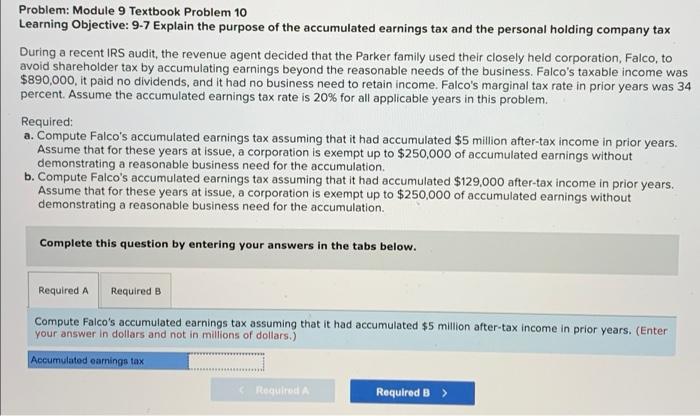

Solved Problem Module 9 Textbook Problem 10 Learning Chegg Com

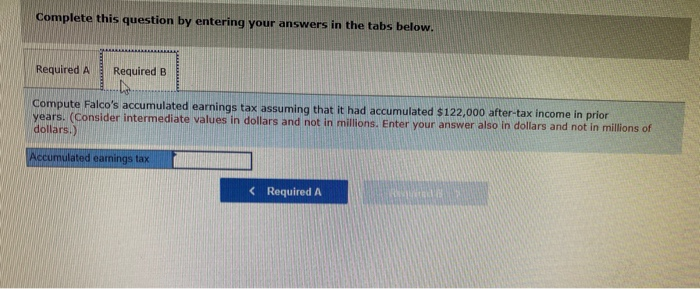

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Bardahl Formula Calculator Defend Against Accumulated Earnings Tax

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

How Corporations May Run Afoul Of The Accumulated Earnings Tax A Section 1202 Planning Brief Frost Brown Todd Full Service Law Firm

Earnings And Profits Computation Case Study

Irs Use Of Accumulated Earnings Tax May Increase

Answered During A Recent Irs Audit The Revenue Bartleby

Reg 2 Corporate Taxation Flashcards Quizlet

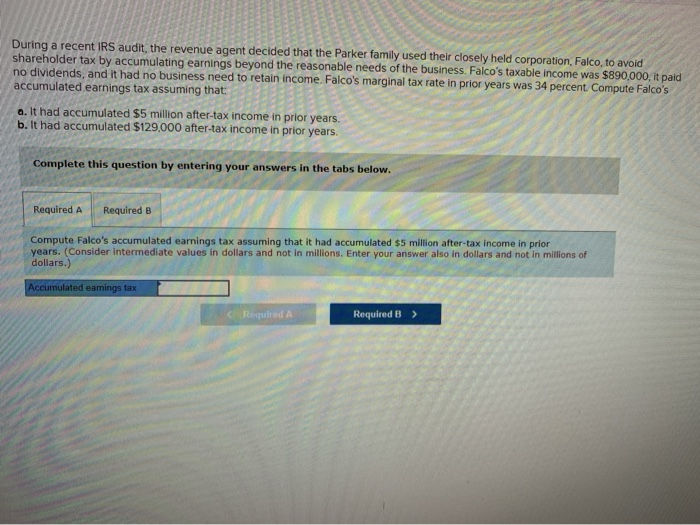

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Corporate Tax Copyright Ppt Download

Strategies For Avoiding The Accumulated Earnings Tax Krd Ltd

Solved Completion Return To Question 10 During A Recent Irs Chegg Com

Earnings And Profits Computation Case Study

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com